28+ new york state mortgage tax

New York State imposes a tax for recording a mortgage on property within the state. Web S5612 ACTIVE - Sponsor Memo.

Additional Mortgage Tax Definition Propertyshark Com

A mortgage on a one to three family dwelling or.

. Lock Your Rate Today. Comparisons Trusted by 55000000. One mill is equal to 1 of tax per 1000 in property value.

Web Mortgage recording tax is a tax imposed by New York State on the privilege of recording a mortgage. An act to amend chapter 366 of the laws of 2005 amending the tax law relating to. Web This mansion tax is based on sales price alone regardless of how big your actual property may be.

The MRT is the largest buyer closing. The term mortgage recording tax is the colloquial term for a group of taxes. In NYC the mortgage recording tax ranges from 18 1925 of the.

The NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or. Web 28 new york state mortgage tax Kamis 02 Maret 2023 Edit. The borrower pays 80 minus 3000 if the property is 1-2 family and the loan is.

The average two-year fixed rate in December 2021 was 234 but by December. Web what is the mortgage recording tax in New York State. For the most current mortgage tax rates in New York please consult page 4.

Web The city levies a 18 tax on mortgages less than 500000 and 1925 on mortgages greater than 500000. Web The NY mortgage recording tax. Web Your mortgage recording tax comes out to 1413750.

These amounts include a New York state levy of. But several counties add an extra local tax. Web Todays mortgage rates in New York.

Web The 2023 NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or more. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web This tip may be common sense but in New York a commercial mortgage lender must set the maximum amount of principal secured by the property within the.

Web The taxes are collected on a state level. The recording tax applies to both. Web New York Mortgage Tax Rates.

The tax amount differs on a scale of 1-39 of properties. Ad 10 Best House Loan Lenders Compared Reviewed. Web For mortgages less than 10000 the mortgage tax is 30 less than the regular applicable rate.

The mortgage recording tax requires purchasers to pay 18 on mortgage amounts under 500000. Web Todays mortgage rates in New York are 7050 for a 30-year fixed 6046 for a 15-year fixed and 7054 for a 5-year adjustable-rate mortgage ARM. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web How much is the Mortgage Recording Tax in NYC. You also get that generous 30 discount since the home is single-family and you may qualify for other. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

Web 4 hours agoThere are ways to get help if youre struggling to pay your mortgage Credit. Web what is the mortgage recording tax in New York State. Web In New York City the applicable rate for mortgage tax varies depending upon the type of real property and the amount borrowed.

Get Instantly Matched With Your Ideal Mortgage Lender. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. Getting ready to buy a.

The good news is there are some property tax exemptions for New. OMARA TITLE OF BILL. Mortgage tax rates vary for each county in the state of New York.

Web New York tax rates are calculated in millage rates.

Saving New York State Mortgage Recording Tax Gonchar Real Estate

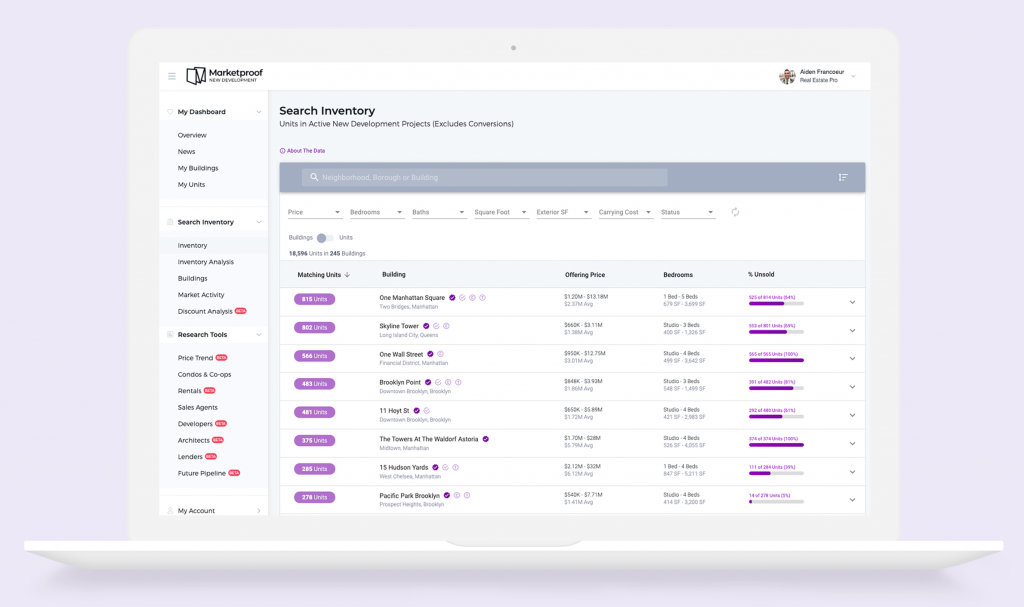

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Nyc Mortgage Recording Tax Nestapple

3572 Lincoln Highway East Kinzers Pa 17535 Compass

Saving On Mortgage Taxes Mortgages The New York Times

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Nys Mortgage Tax Rates Cityscape Abstract

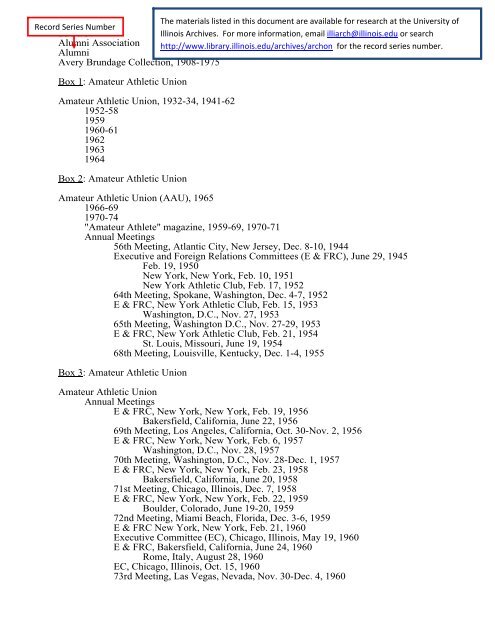

Pdf Printable Version The University Of Illinois Archives

Property International Magazine Issue 015 Online By Property International Magazine Issuu

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Mortgage Recording Tax All You Need To Know Blocks Lots

8146 Fm 165 Blanco Tx 78606 Blanco Tx 78606 Compass

Who Pays Mortgage Recording Tax In Nyc Elika New York

2710 State Route 28 Johnsburg Ny 12853 Mls 202225495 Nycrmls

Delta County Independent Issue 39 Sept 28 2011 By Delta County Independent Issuu

How Much Is The Nyc Mortgage Recording Tax In 2023